Contents

Introduction

When it comes to managing a company’s finances, there are various roles and responsibilities that need to be fulfilled. One such role is that of a fixed asset accountant. In this article, we will explore what a fixed asset accountant does and why their role is crucial for the financial health of an organization.

What is a Fixed Asset?

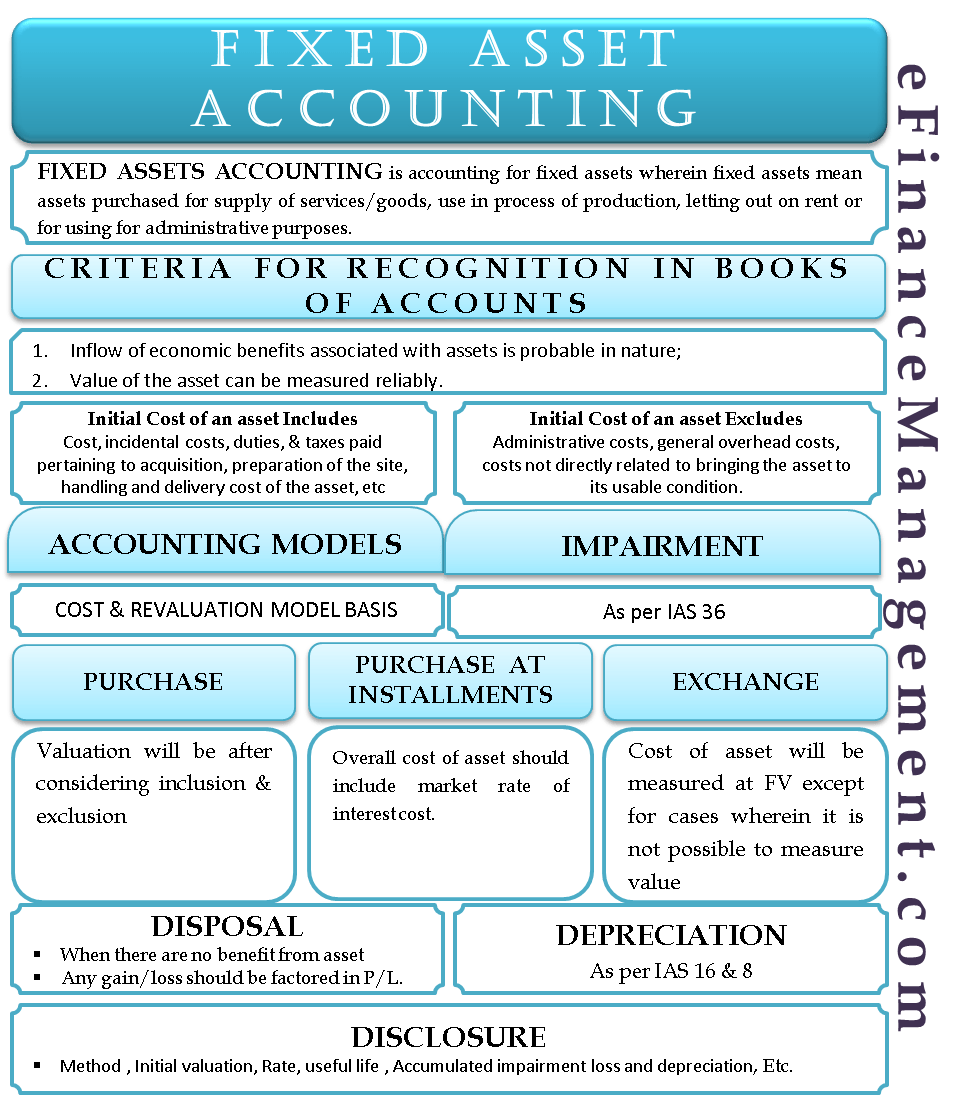

A fixed asset refers to a long-term tangible asset that a company owns and uses to generate revenue. Examples of fixed assets include buildings, machinery, vehicles, and equipment. These assets typically have a useful life of more than one year and are not intended for sale in the ordinary course of business.

The Role of a Fixed Asset Accountant

A fixed asset accountant is responsible for managing and tracking a company’s fixed assets. Their primary role involves recording, reconciling, and analyzing fixed asset transactions. This includes identifying and recording the acquisition, disposal, and depreciation of fixed assets in accordance with accounting standards and company policies.

Asset Acquisition

One of the key responsibilities of a fixed asset accountant is to record the acquisition of new fixed assets. This involves documenting the purchase details, such as the cost, date of acquisition, and supplier information. They also ensure that all necessary supporting documents, such as invoices and purchase orders, are properly maintained for audit purposes.

Asset Disposal

Fixed asset accountants are also responsible for tracking and recording the disposal of fixed assets. This includes documenting the date and method of disposal, as well as any gains or losses incurred. They may also be involved in coordinating the sale or transfer of assets, ensuring that all necessary legal and financial requirements are met.

Depreciation and Amortization

Another important aspect of a fixed asset accountant’s role is to calculate and record the depreciation and amortization of fixed assets. Depreciation refers to the systematic allocation of the cost of an asset over its useful life, while amortization applies to intangible assets. By accurately calculating and recording depreciation and amortization expenses, fixed asset accountants provide valuable information for financial reporting and tax purposes.

Asset Reconciliation

Fixed asset accountants are responsible for reconciling the fixed asset register with the general ledger. This involves comparing the recorded values of fixed assets with supporting documentation and making any necessary adjustments. By ensuring the accuracy and completeness of fixed asset records, they help maintain the integrity of financial statements.

Financial Analysis

In addition to their recording and reconciliation duties, fixed asset accountants may also be involved in financial analysis. They analyze the performance and utilization of fixed assets, identifying opportunities for cost savings or efficiency improvements. By providing insights and recommendations, they contribute to strategic decision-making and the overall financial well-being of the company.

Compliance and Reporting

Fixed asset accountants play a crucial role in ensuring compliance with accounting standards and regulatory requirements. They are responsible for preparing and filing financial reports related to fixed assets, such as depreciation schedules and tax returns. They also collaborate with auditors during financial audits to provide necessary documentation and explanations.

Technology and Automation

With advancements in technology, fixed asset accountants are increasingly leveraging software and automation tools to streamline their processes. They may use specialized accounting software to track and manage fixed assets, facilitate depreciation calculations, and generate reports. By embracing technology, they can improve efficiency, accuracy, and data integrity.

Conclusion

A fixed asset accountant plays a vital role in managing a company’s fixed assets. From recording acquisitions and disposals to calculating depreciation and conducting financial analysis, their responsibilities ensure accurate financial reporting, compliance with regulations, and informed decision-making. Through their expertise and attention to detail, fixed asset accountants contribute to the overall financial health and success of an organization.

More Stories

How Much Does A Staff Accountant Make?

What Is The Best Course In Accounting?

The Truth About School Accountant Salary: What You Need To Know